President Ferdinand Marcos Jr. signed into law the controversial measure creating the Maharlika Investment Fund (MIF) last July 18.

“For the first time in the history of the Philippines, we now have a sovereign wealth fund designed to drive economic development,” said Marcos in his speech at Malacañan Palace.

This came more than a month after the Congress, dominated by a supermajority of Marcos allies, approved the final version of the MIF bill last May 31.

Marcos has certified the bill as urgent for both chambers of Congress to expedite its approval — a move challenged by progressive groups in the Supreme Court but the petition was eventually dismissed.

[READ: Marcos certifies as urgent Maharlika Fund Senate bill]

[READ: SC junks Makabayan bloc’s petition vs Maharlika Fund bill]

The MIF has met criticisms from some lawmakers, progressive groups, and top economists primarily due to its corruption and investment risks, economic viability, and the bill’s hasty approval and erroneous provisions.

However, President Marcos allayed these concerns as he vowed that the MIF is equipped with safeguards and would not be politicized nor be mismanaged.

“Let us make sure that the fund is well-run. Let us make sure that these are professionals. Let us make sure that decisions that are being made for the fund are not political decisions, that they are financial decisions because that is what the fund is. It is essentially a fund that we will continue to invest in,” the President said.

“I contend that we have some of the best economic managers both in government and in the private sector that we can count on to run this fund properly,” he added.

Republic Act No. 11954 will establish the MIF that would be used to invest in domestic and foreign investment products as the government hopes to revive the economy post pandemic.

Unlike other countries with sovereign wealth fund from their surplus budget, the Phillippines will source the seed capital for the MIF from the Land Bank of the Philippines (P50 billion), Development Bank of the Philippines (P25 billion), and the national government (P50 billion).

The original versions of the House proposal received intense public backlash as it sought to get the MIF seed money from the Social Security System and the Government Service Insurance System.

A copy of the newly-signed MIF law is yet to be released by the Malacañang as of posting.

Majority of Filipinos or 51 percent expected little or no benefit from the MIF while 7 percent said they had almost no knowledge or no knowledge at all about it according to a recent survey by the Social Weather Stations.

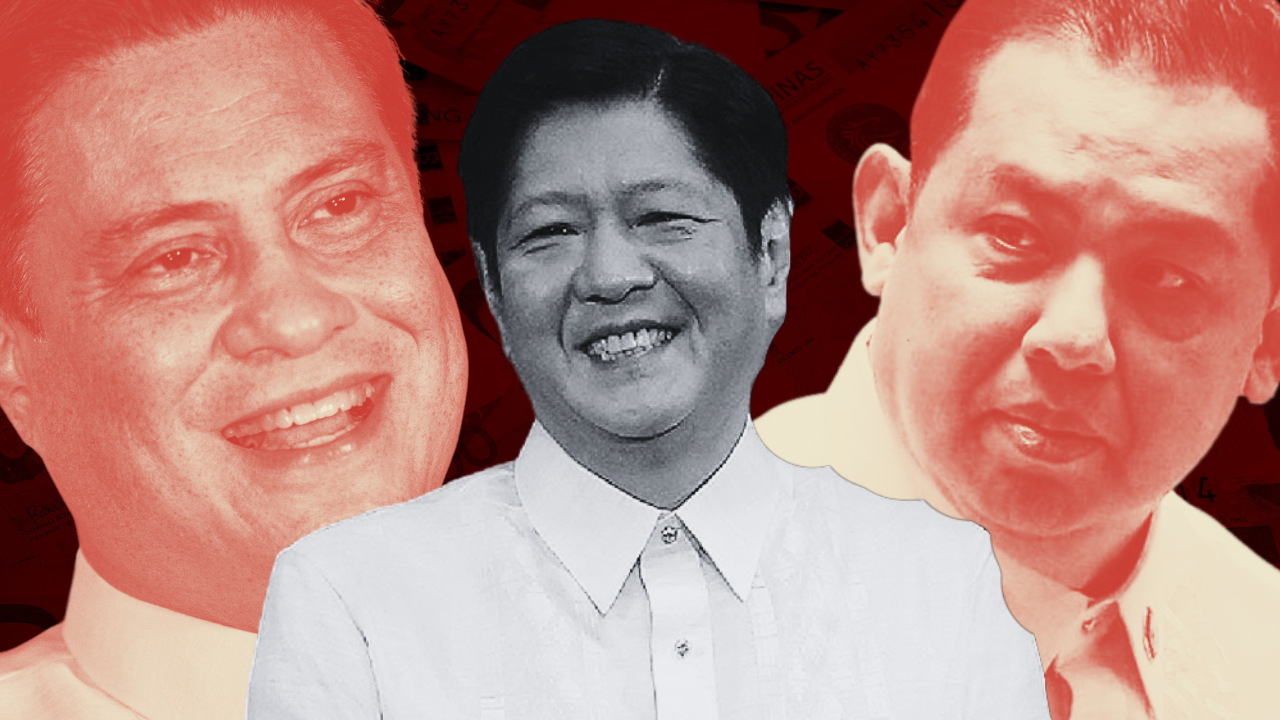

Thumbnail photo made via Canva